Best Identity Put Prices in australia thirty day legit online casino minimum deposit 5 period 5 years

Articles

Score function FTB 3809, Targeted Tax City Deduction and you will Borrowing from the bank Conclusion, for more information. Taxpayers cannot generate/sustain one Corporation Zone (EZ) otherwise Local Company Armed forces Ft Data recovery Town (LAMBRA) NOL for taxable many years birth to your otherwise after January step 1, 2014. Taxpayers is also allege EZ otherwise LAMBRA NOL carryover deduction of earlier many years. Rating form FTB 3805Z, Firm Region Deduction and you will Borrowing Conclusion, otherwise FTB 3807, Local Agency Army Feet Data recovery Town Deduction and you may Borrowing from the bank Realization, for more information. For taxable decades birth to your otherwise just after January step 1, 2019, NOL carrybacks aren’t welcome. The newest NOL carryover deduction ‘s the amount of the brand new NOL carryover out of previous decades which is often deducted out of earnings regarding the current nonexempt seasons.

No-put Roulette Incentives to have British Anyone : 15+ Roulette Also offers – legit online casino minimum deposit 5

Declaration your growth and you will loss on the transformation otherwise transfers of funding assets that aren’t effortlessly linked to a swap otherwise business in the us to the Plan NEC (Mode 1040-NR). Report growth and you will losses out of transformation otherwise exchanges of money legit online casino minimum deposit 5 possessions (in addition to property) that will be effectively regarding a trade or business regarding the Us for the a new Agenda D (Form 1040) otherwise Setting 4797, otherwise one another. If you are engaged in a U.S. trade or business, all of the earnings, gain, or losses to your income tax year you will get of source inside All of us (other than particular funding money) try handled because the efficiently linked money.

Unique Laws to have Canadian and you can German Public Defense Pros

You must install a totally finished Setting 8840 for the income income tax come back to allege you may have a deeper link with an excellent foreign nation otherwise regions. While we can be’t act in person to each and every remark acquired, i create delight in your feedback and will consider your statements and you can suggestions while we modify the tax forms, recommendations, and you may guides. Don’t post tax issues, tax returns, or payments for the more than address.

- You generally get this alternatives once you document your own joint return.

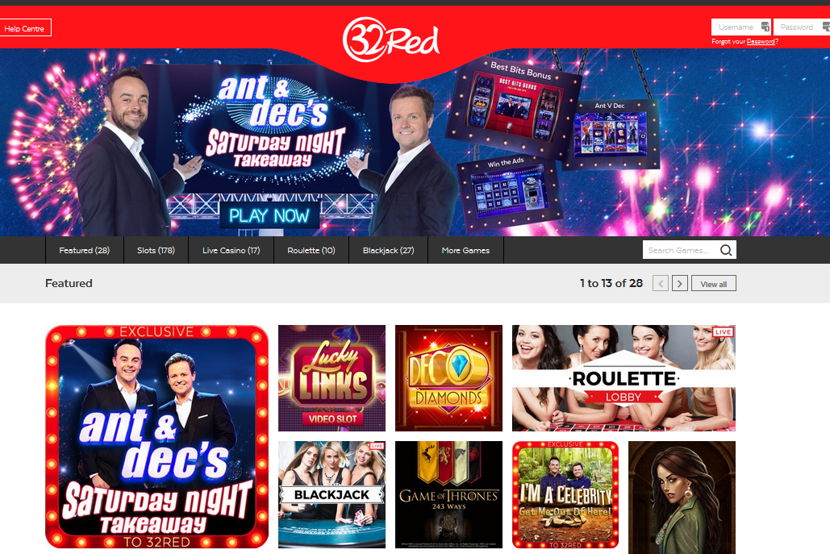

- Inside my assessment, I used a maximum of four other standards to decide if the a gambling establishment is entitled to be on this page, and We rated the brand new gambling enterprises facing both.

- Enter the overall of the many taxable interest in addition to people new matter disregard bonds and you will income acquired as the an owner away from an everyday need for an excellent REMIC.

Private services earnings you get inside a taxation seasons in which you are involved with a great You.S. exchange otherwise organization is effectively related to a good U.S. trading or business. Income gotten inside the annually apart from the entire year your performed the support is also effortlessly linked whether it would have been effectively linked when the received in your performed the support. Personal features income includes wages, salaries, earnings, fees, per diem allowances, and you can employee allowances and you may bonuses. The money can be repaid for you when it comes to cash, features, or possessions. Resident aliens are generally taxed in the same manner since the You.S. owners. Nonresident aliens try taxed based on the supply of their income and you can even though its income is actually efficiently related to an excellent You.S. change otherwise business.

Simply enduring this type of free converts will need you a great little bit of day since there are just a lot of ones. But not, Royal Las vegas Casino wouldn’t disappoint with the complete games choices after you might be finishing up and able to are another thing. So it small deposit online casino has been common for a long go out mostly by large numbers from headings he’s regarding the best team on the video game. Top10Casinos.com cannot provide gambling organization that is maybe not a betting driver. You can expect local casino and you may sports betting now offers from third-party casinos. Top10Casinos.com try supported by the members, after you click on all ads to the our site, we might earn a percentage from the no extra costs to you.

An educated $5 Lowest Deposit Bonuses inside NZ

Save money and avoid unwelcome unexpected situations by avoiding these types of twenty five very first-date occupant errors. If you wish to learn more about your own occupant’s liberties here are a few this type of additional tips so you can make the very best of their leasing sense. Should your property owner is required to spend you accrued desire, it must be produced in your own book. If you don’t see this information on your book, here are a few the effortless resource condition-by-county bottom line. Your property manager may charge your some charge such as late, amenity (fitness center, laundry), early termination, on the internet credit card control, software, attorney, vehicle parking, and you can stores costs. As we don’t provide people chapels to your university, you will find chaplains at each neighborhood one keep low-denominational religious functions for citizens.

The main cause from a taxation compensation fringe work for is decided based to your precise location of the jurisdiction one enforced the new income tax to have which you try refunded. You can utilize a good equipment of time below a day from the a lot more than tiny fraction, if the appropriate. The timeframe where the newest payment is made doesn’t should be annually. Instead, you can use other line of, separate, and you may continuing time frame if you’re able to present for the satisfaction of your Internal revenue service this almost every other months is far more appropriate. If you were a great U.S. resident inside the 2024 however they are not an excellent U.S. citizen during the one element of 2025, your quit getting an excellent U.S. resident on your own abode termination go out. Your own residence termination day is actually December 31, 2024, if you don’t qualify for an early on date, because the talked about later.